Acquisition rationale

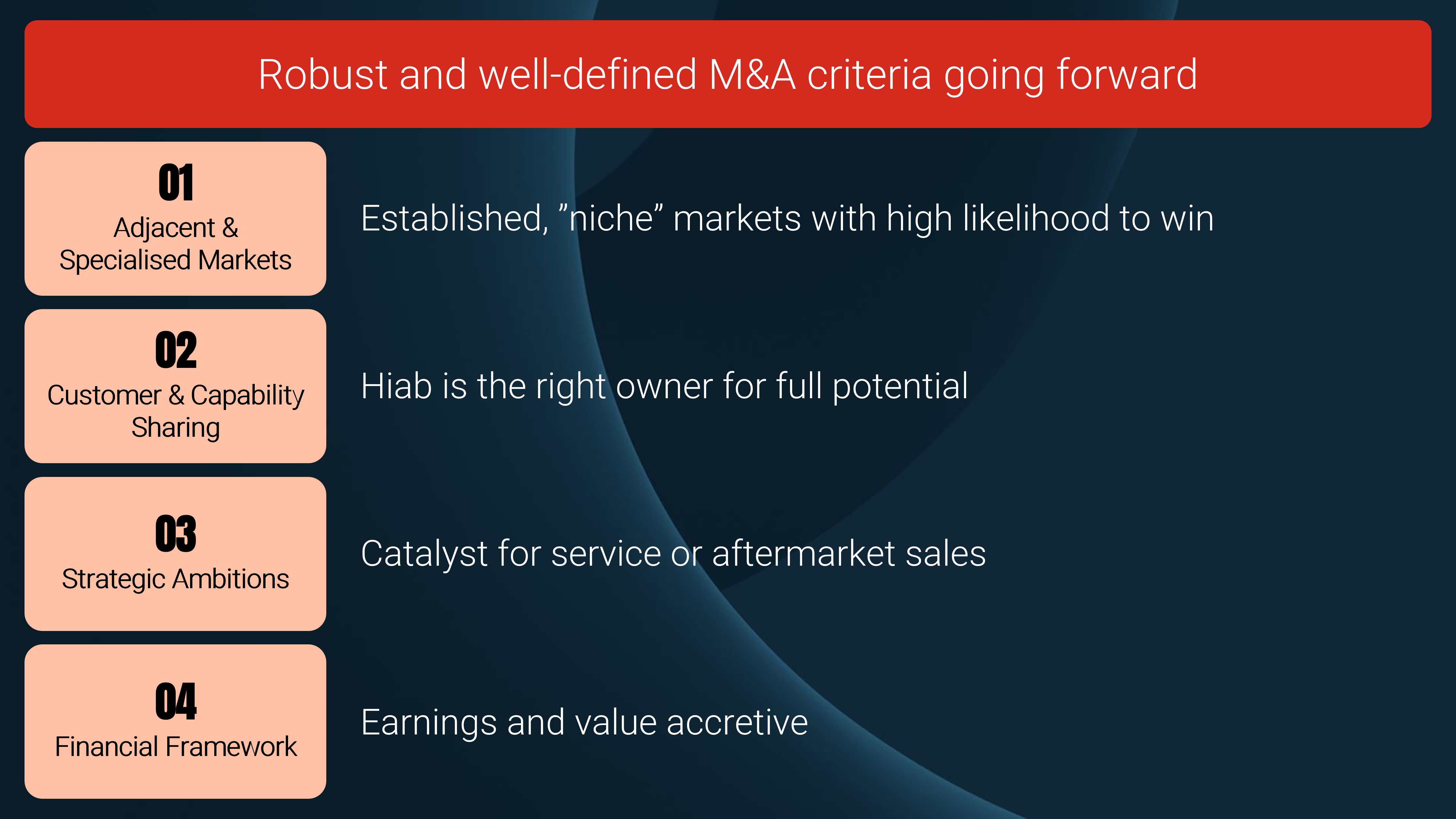

Well defined M&A criteria

Hiab is actively developing and maintaining its M&A pipeline. The aim of a potential M&A would be to strengthen Hiab’s portfolio and to complement the offering, enter new developing markets and seek growth in adjacent segments. Hiab has a strong balance sheet and cash generation capabilities to finance potential acquisitions.

Recent major acquisitions

Today's Hiab has been put together by a series of acquisitions

Hiab's history is built on innovation and leadership. With a track record of industry firsts, our specialist brands often define the categories they created. We're not just reacting to the future of load handling; we're actively shaping it for essential industries.

This commitment is evident in our pioneering advancements, including connectivity, data-driven service, electrification, and VR training. These aren't just buzzwords; they represent tangible solutions designed to optimise efficiency, enhance safety, and drive sustainability for our customers.

This forward-thinking approach, deeply rooted in our rich heritage and a deep understanding of our customers' evolving needs, positions Hiab to continue leading the way for years to come, delivering the next generation of load handling solutions.